AI Bookkeeping Automation for Small Business: Guide & Tips

Reducing Errors and Saving Time

Key Takeaways

- AI bookkeeping automates tasks like data entry and reconciliation, saving small businesses time and reducing errors.

- Using AI, small businesses can gain real-time financial insights, enabling better decision-making and strategic planning.

- AI tools integrate seamlessly with popular accounting software, ensuring smooth transitions and minimal disruption.

- Top AI bookkeeping solutions include Booke AI and QuickBooks Online, each offering unique features tailored for small businesses.

- Implementing AI bookkeeping requires training your team and setting up tools correctly for maximum efficiency.

AI Bookkeeping and Its Impact on Small Businesses

AI is transforming bookkeeping for small businesses. By automating repetitive tasks, AI enables business owners to focus on growth rather than mundane details. Imagine no longer spending hours on manual data entry or reconciliation. Instead, AI handles these tasks with speed and precision, freeing up your time for more strategic activities.

Transforming Financial Management with AI

Artificial intelligence isn't just about automation; it's about enhancing financial management. AI provides real-time insights into your finances, allowing you to make informed decisions quickly. For instance, you can instantly see how a new expense impacts your cash flow or predict future trends based on historical data. This level of insight was once only available to large corporations with big budgets, but AI levels the playing field for small businesses.

Benefits of Automation in Bookkeeping

Automation brings several advantages to bookkeeping:

- Time-saving: AI automates repetitive tasks, freeing up hours every week.

- Accuracy: Reduces human errors in data entry and calculations.

- Cost-effective: Lowers the need for extensive manual labor, cutting costs.

- Scalability: Easily adapts to growing business needs without additional resources.

By leveraging AI, small businesses can maintain accurate records without the hassle of manual bookkeeping. This efficiency is crucial for businesses looking to scale without being bogged down by administrative tasks. For more information, explore how AI in bookkeeping is changing small business accounting.

Challenges Addressed by AI Solutions

AI addresses several challenges in traditional bookkeeping. One major issue is the risk of human error, which can lead to costly mistakes. AI minimizes this risk by automating data entry and calculations. Another challenge is the time-consuming nature of bookkeeping. AI speeds up processes, allowing you to focus on more critical aspects of your business. Finally, AI helps with compliance by ensuring that your financial records are up-to-date and accurate, reducing the risk of audits and penalties.

How AI Bookkeeping Works

- Data Entry: AI captures and inputs financial data from various sources automatically.

- Reconciliation: It matches transactions to ensure accuracy between accounts.

- Reporting: Generates financial reports and insights in real-time.

- Forecasting: Uses historical data to predict future financial trends.

AI bookkeeping tools use advanced algorithms to process and analyze financial data with clear AI ROI metrics. These tools learn from patterns in your data, becoming more accurate over time. By continuously learning, AI can adapt to changes in your business, ensuring that your financial management remains efficient and effective.

Let's take a deeper dive into the core technologies behind AI bookkeeping and how they integrate with existing accounting systems.

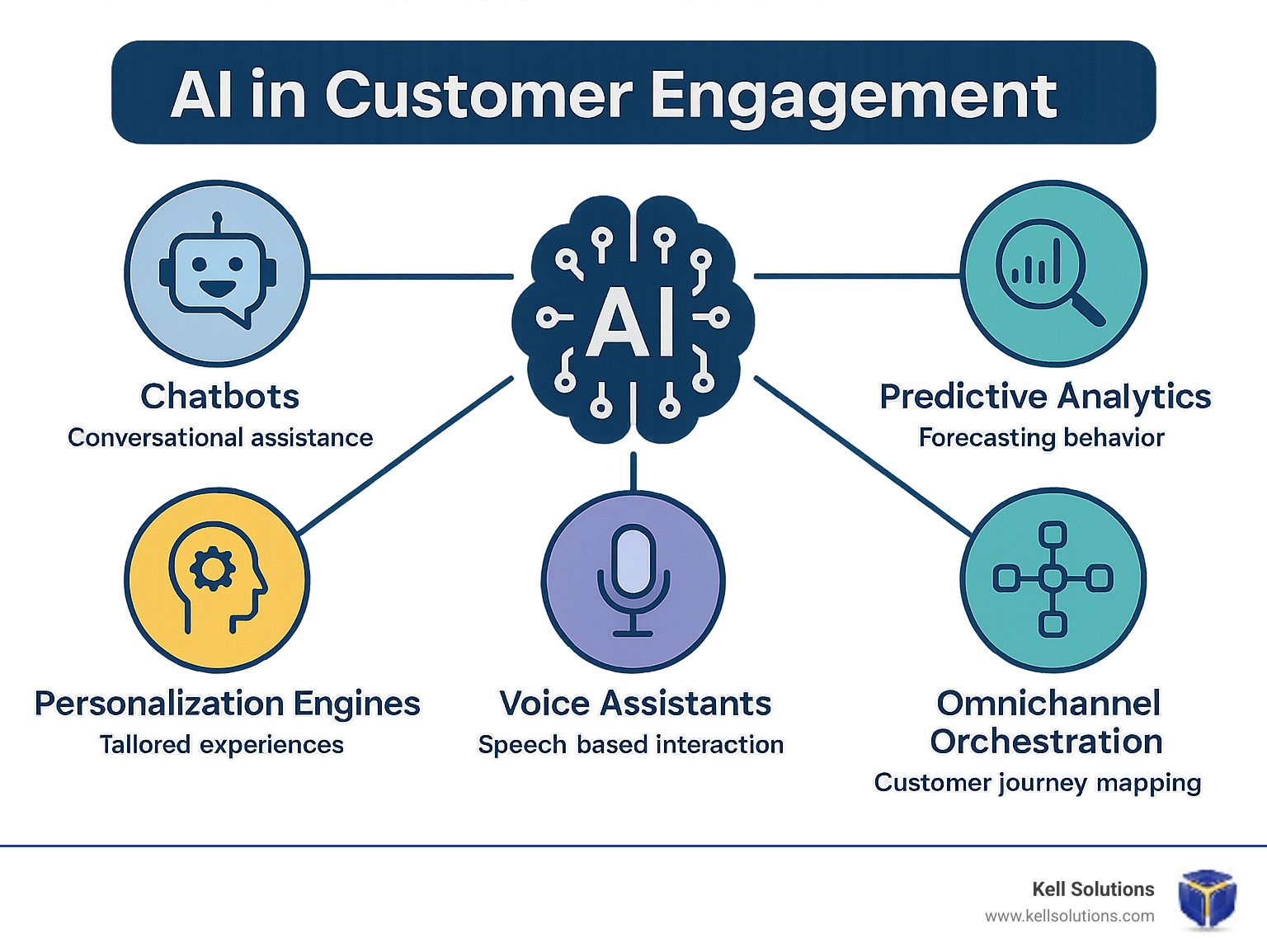

Core Technologies Behind AI Bookkeeping

AI bookkeeping relies on several key technologies, including machine learning, natural language processing, and optical character recognition (OCR). Machine learning enables AI to learn from data patterns, improving its accuracy over time. Natural language processing allows AI to understand and process human language, making it easier to interact with the system. OCR technology is used to convert different types of documents, such as invoices and receipts, into editable and searchable data. Together, these technologies create a powerful tool for managing your finances.

Integration with Existing Accounting Systems

AI bookkeeping solutions are designed to integrate seamlessly with popular accounting software like QuickBooks and Xero. This integration ensures that your financial data is synchronized across platforms, minimizing the risk of errors. Additionally, AI tools can pull data from various sources, such as bank statements and invoices, to provide a comprehensive view of your financial health. By integrating AI with your existing systems, you can enhance your financial management without disrupting your current processes.

Other Notable AI Bookkeeping Platforms

Besides Booke AI and QuickBooks Online, several other AI bookkeeping platforms are making waves in the industry. These tools offer unique features that cater to the specific needs of small businesses. For instance, Xero's AI capabilities streamline invoicing and payroll processes, making it a popular choice for businesses with complex billing requirements.

Another noteworthy platform is FreshBooks, which uses AI to automate time tracking and expense management. This feature is particularly beneficial for service-based businesses that need to bill clients based on hours worked. By choosing the right AI bookkeeping platform, you can ensure that your financial management is as efficient and effective as possible.

Implementing AI Bookkeeping in Your Business

Integrating AI into your bookkeeping processes can seem daunting, but it doesn't have to be. With the right approach, you can transition smoothly and start reaping the benefits of automation. The key is to plan carefully and ensure that your team is prepared for the change.

First, assess your current bookkeeping processes to identify areas that would benefit most from automation. This assessment will help you choose the right AI tools for your business. Next, develop a detailed implementation plan that outlines the steps you need to take to integrate AI into your existing systems. This plan should include timelines, responsibilities, and milestones to keep you on track.

Steps for Smooth Transition to AI Systems

To ensure a smooth transition to AI bookkeeping, follow these steps: consider exploring how automation is changing small business accounting to better understand the benefits and challenges involved.

- Evaluate Needs: Determine which bookkeeping tasks would benefit most from automation.

- Select Tools: Choose AI bookkeeping solutions that align with your business needs and budget.

- Create a Plan: Develop a comprehensive implementation plan with clear timelines and responsibilities.

- Test the System: Run a pilot test to identify potential issues and make necessary adjustments.

- Roll Out Gradually: Implement AI tools in phases to minimize disruptions and allow time for adjustments.

By following these steps, you can ensure a successful AI Integration in business processes including AI bookkeeping, maximizing the benefits of automation for your business.

Training Your Team for AI-Driven Processes

Training your team is crucial for the successful implementation of AI bookkeeping. Start by educating your employees on the benefits of AI and how it will impact their roles. Provide hands-on training sessions to familiarize them with the new tools and processes. Encourage open communication and address any concerns they may have about the transition.

It's also important to provide ongoing support and resources to help your team adapt to the new system. Consider appointing a dedicated AI champion within your team to oversee the transition and provide assistance as needed. By investing in training and support, you can ensure that your team is fully equipped to embrace AI-driven processes.

Setting Up AI Bookkeeping Tools

Setting up AI bookkeeping tools involves several key steps. First, ensure that your software is compatible with your existing accounting systems. Most AI tools offer easy integration with popular platforms like QuickBooks and Xero, but it's important to verify compatibility before proceeding.

Next, configure the AI tools to match your specific business needs. This may involve setting up automated workflows, customizing reports, and defining user roles and permissions. Once the setup is complete, test the system to ensure that everything is functioning correctly. Address any issues promptly to avoid disruptions to your bookkeeping processes.

Maximizing Efficiency and Accuracy in Bookkeeping

To get the most out of your AI bookkeeping tools, it's important to utilize their features effectively. By leveraging the full capabilities of AI, you can enhance efficiency and accuracy in your financial management.

Utilizing AI Features for Better Results

AI bookkeeping tools offer a range of features designed to improve financial management. For example, many tools provide real-time financial insights, allowing you to make informed decisions quickly. Use these insights to identify trends, forecast future performance, and make strategic adjustments to your business operations.

Additionally, take advantage of AI's ability to automate repetitive tasks. This automation not only saves time but also reduces the risk of errors, ensuring that your financial records are accurate and up-to-date. By fully utilizing AI features, you can streamline your bookkeeping processes and focus on growing your business.

Best Practices for Data Management

Effective data management is crucial for maximizing the benefits of AI bookkeeping. Start by ensuring that your financial data is organized and up-to-date. Regularly review and clean your data to remove duplicates and correct errors. This practice will improve the accuracy of your AI tools and enhance their ability to provide valuable insights.

It's also important to maintain data security to protect sensitive financial information. Use secure passwords, enable two-factor authentication, and regularly back up your data to prevent loss. By following these best practices, you can ensure that your AI bookkeeping tools operate efficiently and securely.

Case Studies of Successful AI Integration

Real-world examples of AI integration can provide valuable insights into the benefits of automation for small businesses. Here are a few success stories that demonstrate the impact of AI bookkeeping.

- Local Retailer: A small retail business implemented AI bookkeeping to automate inventory management and financial reporting. As a result, they reduced time spent on manual tasks by 50% and improved accuracy in their financial records.

- Freelance Agency: A freelance agency adopted AI tools to streamline invoicing and expense tracking. This change allowed them to reduce billing errors and improve cash flow management, leading to increased client satisfaction.

These success stories highlight the transformative power of AI bookkeeping for small businesses. By embracing automation, these businesses have achieved significant improvements in efficiency, accuracy, and overall financial management.

Small Business Success Stories

One inspiring example comes from a small tech startup that struggled with manual bookkeeping processes. By implementing AI tools, they automated their payroll and expense tracking, reducing administrative workload by 60%. This change allowed the team to focus on product development and customer acquisition, leading to a 30% increase in revenue within the first year of adopting AI.

Another success story involves a family-owned restaurant that used AI to manage their finances. By automating data entry and reconciliation, they reduced errors and improved financial visibility. This improvement enabled them to make strategic investments in marketing and menu development, resulting in increased customer engagement and higher profits.

Measurable Improvements in Productivity

AI bookkeeping has shown measurable improvements in productivity for many small businesses. For example, a local bakery implemented AI to manage its finances, reducing the time spent on bookkeeping by 40%. This efficiency allowed the owner to focus more on product development and customer service, leading to a noticeable increase in customer satisfaction and sales.

Another small business, a digital marketing agency, saw a 50% reduction in the time spent on invoicing and payroll after integrating AI solutions. This time-saving enabled the agency to take on more clients, ultimately increasing their revenue by 25% over six months.

Future Trends in AI Bookkeeping

As technology continues to advance, the future of AI bookkeeping looks promising. Businesses can expect even more sophisticated tools that offer enhanced capabilities and improved accuracy. These advancements will further streamline financial management, making it easier for small businesses to thrive in a competitive market.

One of the most exciting trends is the integration of AI with other emerging technologies, such as blockchain and the Internet of Things (IoT). These integrations will provide even more robust solutions for financial management, offering greater transparency and security.

Evolving Capabilities and Tools

AI bookkeeping tools are constantly evolving to meet the changing needs of businesses. Future tools will likely offer enhanced predictive analytics, allowing businesses to forecast financial trends with greater accuracy. This capability will enable small businesses to make more informed decisions, reducing risks and optimizing growth opportunities.

Predicted Innovations in Bookkeeping

Innovations in AI bookkeeping are expected to focus on improving user experience and accessibility. For instance, voice-activated commands and intuitive interfaces will make it easier for business owners to interact with their financial data. Additionally, AI tools will become more customizable, allowing businesses to tailor solutions to their specific needs.

FAQ

As AI bookkeeping becomes more prevalent, business owners may have questions about its AI adoption strategy, implementation and benefits. Here are some common questions and answers to help guide you in your journey.

What is AI Bookkeeping?

AI bookkeeping refers to the use of artificial intelligence to automate and enhance traditional bookkeeping tasks. This includes data entry, reconciliation, financial reporting, and more. By leveraging AI, businesses can streamline their financial management processes and gain valuable insights into their financial health.

AI tools use machine learning algorithms to analyze financial data, identify patterns, and make predictions. This technology allows businesses to manage their finances more efficiently and effectively.

How Can AI Improve Bookkeeping Accuracy?

AI improves bookkeeping accuracy by minimizing human errors in data entry and calculations. Automated processes ensure that financial data is recorded consistently and accurately, reducing the risk of discrepancies. Additionally, AI tools can quickly identify and flag anomalies, allowing businesses to address potential issues promptly.

Are There Any Risks Associated with AI Bookkeeping?

While AI bookkeeping offers numerous benefits, there are some potential risks to consider. One concern is data security, as financial information is sensitive and must be protected. Businesses should ensure that their AI tools have robust security measures in place to prevent unauthorized access and data breaches.

Another risk is over-reliance on AI, which can lead to complacency in financial management. It's important for businesses to maintain oversight and regularly review their financial data, even when using AI tools.

What Should Small Businesses Look for in an AI Bookkeeping Tool?

When choosing an AI bookkeeping tool, small businesses should consider several factors:

- Compatibility: Ensure the tool integrates seamlessly with existing accounting systems.

- Ease of Use: Look for user-friendly interfaces that require minimal training.

- Features: Consider the specific features offered, such as real-time insights and predictive analytics.

- Security: Verify that the tool has strong security measures to protect financial data.

- Cost: Evaluate the pricing structure to ensure it fits within your budget.

By carefully evaluating these factors, businesses can choose an AI bookkeeping tool that meets their needs and enhances their financial management.

How Quickly Can a Small Business Implement AI Bookkeeping?

The time required to implement AI bookkeeping varies depending on the complexity of the business's financial processes and the chosen AI tool. Generally, businesses can expect the implementation process to take anywhere from a few weeks to a couple of months.

To expedite the process, businesses should start by assessing their current bookkeeping practices and identifying areas that would benefit most from automation. This assessment will help in selecting the right AI tool and developing a detailed implementation plan.

Once the plan is in place, businesses can begin the setup process, including integrating the AI tool with existing systems and training their team. By following a structured approach, small businesses can implement AI bookkeeping efficiently and start reaping the benefits of automation.

Orange County HVAC Google AI Overview Domination: 7 Proven Strategies to Capture Featured AI Results